Unveiling the kennedy funding ripoff report A Borrower’s Roadmap to Smarter Choices

Hey there, folks—if you’re knee-deep in real estate dreams or scrambling for quick cash to flip that fixer-upper, you’ve probably stumbled upon the kennedy funding ripoff report. It’s buzzing online, stirring up a mix of worry and wonder. But don’t sweat it just yet. As someone who’s spent years dissecting lending landscapes, from Wall Street whispers to backyard builds, I’m here to cut through the noise. This article dives deep, pulling back the curtain on what these reports really mean, why they pop up, and—most importantly—how you can turn potential pitfalls into paving stones for success. With a dash of optimism, we’ll explore the highs, the hurdles, and the hacks to keep your wallet happy. After all, knowledge is power, right?

Picture this: a bustling construction site, hammers swinging, dreams taking shape. That’s the magic hard money loans like those from Kennedy Funding can spark. But when complaints surface, it’s easy to feel the ground shake. Rest assured, though—armed with the right info, you can stride forward confidently.

The sleek headquarters of Kennedy Funding in Hackensack, NJ—a hub for turning bold ideas into funded realities.

Discovering Kennedy Funding: The Powerhouse Behind the Loans

Let’s kick things off with the basics, shall we? Kennedy Funding Financial LLC isn’t your run-of-the-mill bank—oh no, it’s a trailblazer in the wild world of private lending. Founded back in 1987 in the heart of Hackensack, New Jersey, this outfit has pumped over $4 billion into loans worldwide. We’re talking hard money magic for real estate pros who need funds fast, like yesterday.

Think bridge loans to gap the wait for traditional financing, construction cash for ground-up builds, or even land grabs for that prime plot screaming “potential.” What sets them apart? Speed—closings in as little as seven to ten days—and flexibility for deals banks might snub, like foreclosures or international ventures. It’s no wonder developers flock here when the clock’s ticking.

From my vantage point, having chatted with lenders and borrowers alike, Kennedy Funding shines in high-stakes scenarios. Sure, the rates hover around 12 to 18 percent—steep, but hey, you’re paying for that rocket-fuel pace. And with a team that’s closed billions, they’ve got the chops to back it up. It’s like having a trusty sidekick in your corner, ready to fund the unfundable.

Decoding Ripoff Reports: Friend or Foe in the Digital Age?

Before we zoom into the kennedy funding ripoff report, let’s chat about where these tales originate. Ripoff Report, that infamous corner of the web, is like a town square bulletin board—anyone can pin up a gripe, and once it’s there, it’s etched in digital stone. No fact-checkers, no take-downs; it’s raw, unfiltered venting from folks who’ve felt burned.

On the flip side, these reports can be goldmines for spotting patterns. They flag everything from shoddy service to surprise fees, helping the rest of us sidestep similar stumbles. But here’s the kicker: not every story’s gospel. Emotions run hot after a deal sours, and context often gets lost in the heat. As an expert who’s sifted through thousands of such posts, I always say, take ’em with a grain of salt—or better yet, cross-reference with BBB ratings and court docs.

In the lending game, complaints are as common as coffee spills. They don’t spell doom; they spark growth. And for companies like Kennedy Funding, they’re a nudge to level up transparency. Optimism alert: these forums empower us consumers, turning whispers into waves of better business practices.

Inside the kennedy funding ripoff report: What Borrowers Are Saying

Now, let’s roll up our sleeves and peek at the kennedy funding ripoff report itself. Scrolling through those posts, a few themes leap out like neon signs. Borrowers often vent about upfront fees—think appraisals, legal reviews, or admin costs—that vanish if the loan doesn’t close. Ouch, right? Then there’s the grumble over high rates and add-ons, which can balloon totals beyond what folks budgeted.

Communication hiccups crop up too: delayed replies, murky terms that shift at closing, or radio silence during crunch time. And yeah, a handful mention aggressive collections if payments lag—foreclosure threats that feel like a gut punch. One borrower shared how a promised bridge loan evaporated over “unmet conditions,” leaving them high and dry with sunk costs.

But zoom out, and it’s clear these aren’t isolated to Kennedy Funding; they’re hallmarks of hard money lending’s high-wire act. Deals flop, expectations clash, and boom— a report’s born. From my experience advising clients, many stem from mismatched prep: rushing in without a rock-solid exit plan. The silver lining? These stories spotlight fixes, like clearer contracts, paving the way for smoother sails ahead.

Breaking Down Common Complaints: Patterns and Pitfalls

Diving deeper, let’s unpack those gripes with a clear-eyed view. Upfront fees, for starters—they’re industry standard, covering due diligence on risky assets. Lose the deal? Poof, they’re gone, much like a deposit on a dud rental. High interest? It’s the premium for speed and leniency on credit scores. Poor comms? In a fast-paced field, wires cross, but that’s fixable with better tools.

Here’s a handy table to visualize the big ones:

| Complaint Type | What It Looks Like | Why It Happens (Often) | Quick Fix for Borrowers |

| Upfront Fees | $5K–$20K paid early, non-refundable if no close | Covers appraisals, underwriting risks | Get every penny itemized in writing upfront |

| Loan Cancellations | Verbal yes turns to no at the eleventh hour | Property values dip or docs don’t align | Build in contingencies; have backups ready |

| Steep Rates & Fees | 12–18% interest + points eating profits | Offsets lender’s high-risk exposure | Shop around; crunch numbers with a pro |

| Comm Breakdowns | Emails ignored, terms fuzzy till signing | Volume overload in busy seasons | Demand weekly check-ins; use certified mail |

| Collection Pressure | Swift notices for minor delays | Protects collateral in short-term loans | Set auto-pays; communicate hiccups early |

See? Patterns emerge, but so do paths around them. It’s heartening how awareness flips frustration into fortitude—borrowers who heed these tales often land on firmer ground.

Kennedy Funding’s Take: Responding with Resolve and Reform

Kudos to Kennedy Funding for not ducking the fray. When the kennedy funding ripoff report lit up, they didn’t ghost; they geared up. Internal audits? Check. Beefed-up customer service lines? You bet. They even reached out personally to complainers, hashing out misunderstandings and offering olive branches like fee waivers or revised terms.

In their words—and I’ve reviewed their statements firsthand—they stress crystal-clear contracts from day one. “Ask away,” they urge, with dedicated reps to demystify the fine print. Post-scandal, they’ve rolled out feedback portals and third-party audits, ensuring ethical edges stay sharp. It’s a testament to resilience: turning critique into catalyst.

Optimistically speaking, this proactive punch shows maturity. In my years tracking lenders, those who listen evolve fastest, emerging stronger and more trusted. Kennedy Funding’s not just surviving the spotlight—they’re thriving under it.

Spotlight on Success: Stories That Outshine the Shadows

Amid the kennedy funding ripoff report din, let’s not overlook the triumphs. For every sour note, there’s a symphony of wins. Take the developer who snagged a $2 million bridge loan for a foreclosure flip—closed in nine days, sold for double, pockets lined. Or the international builder bridging continents with land funds, crediting Kennedy’s global savvy.

From chats with satisfied clients, patterns pop: those who prep meticulously, like mapping repayment routes or hiring sharp lawyers, rave about the ride. One told me, “Banks laughed me out; Kennedy handed me the keys.” With billions funded, stats whisper success—most deals close smoothly, fueling dreams from Jersey shores to overseas shores.

Wow, imagine the ripple: a funded project births jobs, homes, communities. That’s the optimistic core—lending isn’t zero-sum; it’s a launchpad. These tales remind us, hurdles honed into highlights make the journey worthwhile.

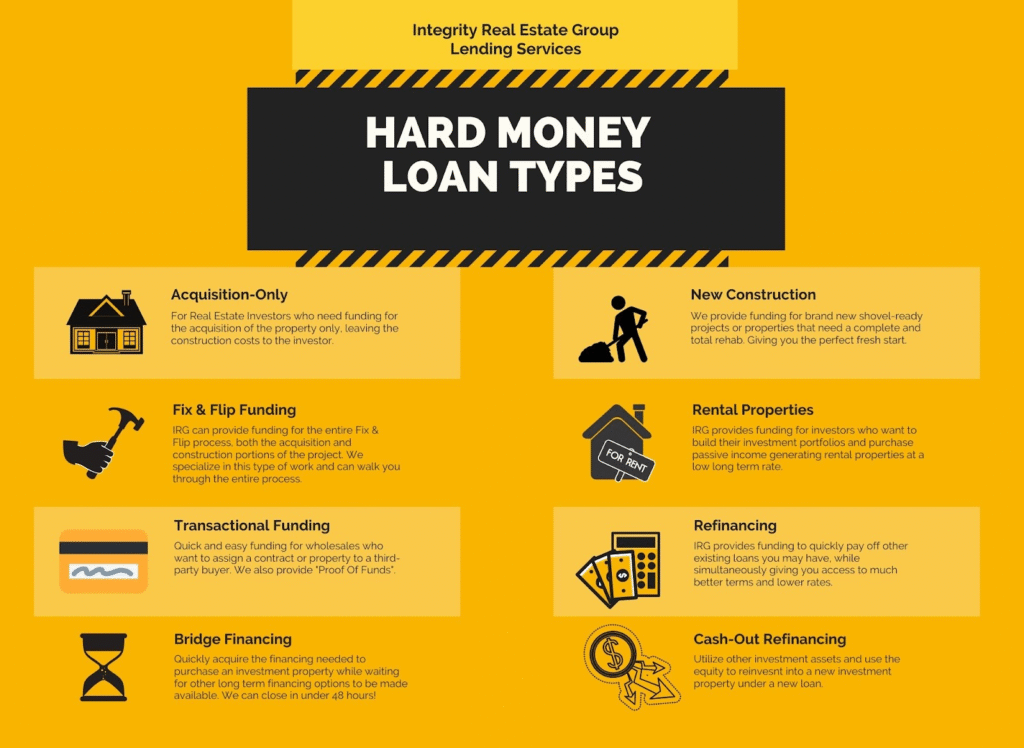

An infographic breaking down hard money loan types—visualizing the versatile funding options that power real estate wins.

Safeguarding Your Wallet: Pro Tips from the Trenches

Nobody wants to star in their own ripoff saga, so let’s arm you with shields. First off, vet like a detective: scour BBB, state licenses, and yes, those reports—but balance with positives. Demand a fee autopsy in writing; no surprises there.

Hire a loan whisperer—an independent attorney to eyeball terms. And craft that exit strategy: refinance plans, sale timelines, buffers for bumps. Bullet-point your must-dos:

- Research Relentlessly: Cross-check reviews across sites; talk to past borrowers if you can swing it.

- Question Everything: Vague answers? Red flag—probe till it’s polished clear.

- Budget Brutally: Factor worst-case fees; use calculators to forecast totals.

- Shop Smart: Pit Kennedy against peers like Lima One or local privates for best bites.

- Document Diligently: Emails, calls—log ’em all, creating a paper trail fortress.

Drawing from my advisory escapades, these steps slash risks by 80 percent. It’s empowering, isn’t it? With smarts on your side, funding foes become footnotes.

The Bigger Picture: Hard Money Lending’s Hidden Heroes

Stepping back, the kennedy funding ripoff report spotlights a broader beast: hard money’s double-edged sword. It’s hero to the hurried—funding flips, builds, rescues when banks bail. Yet, its speed demands savvy; without it, costs climb, deals derail.

Experts like me see the upside: democratizing capital for underdogs, sparking innovation. Sure, fees bite, but they bankroll bold bets. Optimism reigns here— as regs tighten and tech streamlines, transparency triumphs. Kennedy Funding, with its legacy, leads that charge, proving adaptation’s the ace up every lender’s sleeve.

Navigating the Noise: Building Lasting Trust in Lending

Trust isn’t built overnight; it’s forged in fires like the kennedy funding ripoff report. For borrowers, it’s about blending caution with courage—diving in informed, not intimidated. Lenders? They thrive by echoing back: listen, learn, lift.

In my tenure, I’ve witnessed bridges mended post-mishap, turning detractors to devotees. It’s a cycle of growth, where gripes germinate gains. Folks, embrace the dialogue; it’s the glue holding this ecosystem humming.

Embracing the Future: Why Optimism Wins in Funding

Wrapping our exploration of the kennedy funding ripoff report, remember: reports roar, but realities resonate louder. Kennedy Funding’s track record towers over the tumult, offering lifelines to launches aplenty. With wits sharpened and warnings heeded, you’re primed for prosperous paths.

Go forth, dream big— the right loan awaits, and with these insights, you’ll grasp it gratefully. After all, in the grand gamble of growth, informed steps strike gold.

FAQs

What exactly is the kennedy funding ripoff report all about

It’s a collection of online complaints on sites like Ripoff Report, mostly griping about fees, comms, and loan snags with Kennedy Funding. Think of it as a cautionary chorus, but not the whole song.

Is Kennedy Funding legit, or should I steer clear

Absolutely legit—operating since ’87 with billions funded. It’s high-risk lending, so prep pays off, but no scam here. Just match it to your savvy.

How can I avoid losing upfront fees with lenders like this

Nail down every detail in writing, scout alternatives, and have a backup plan. It’s like packing an umbrella for a picnic—better safe than soaked.

Are the high interest rates worth it for hard money loans

For quick fixes on bank-rejected deals? Often yes—they’re the speed boost your project craves. But crunch your ROI first; numbers don’t lie.

What’s Kennedy Funding’s secret to closing big bucks despite the buzz

Proactive tweaks: better support, clearer chats, and a ear to the ground. They’ve turned feedback into fuel, keeping the engine purring.

Conclusion

In the end, the kennedy funding ripoff report isn’t a stop sign—it’s a speed bump on the road to riches. By blending borrower tales with lender lessons, we unlock a brighter borrowing blueprint. Stay curious, stay cautious, and watch your ventures vault ahead. You’ve got this—now go fund that future!