Title: Biitland.com Stablecoins The Future of Stable, Secure Digital Value

Introduction

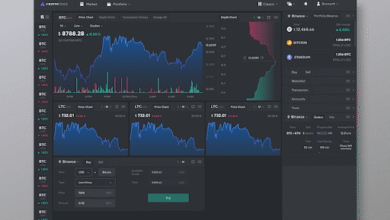

In today’s rapidly evolving world of cryptocurrency, biitland.com stablecoins stand out as a beacon of stability, innovation, and adaptability. These digital assets, anchored to real-world value, offer an intuitive, user-friendly pathway into decentralized finance (DeFi) without the volatility often associated with crypto. This article explores what biitland.com stablecoins are, how they work, why they matter, and how you can benefit from them.

1. What Are Biitland.com Stablecoins

At their core, biitland.com stablecoins are blockchain-based tokens pegged to tangible assets—such as the US dollar, euro, or even gold—designed to hold a steady value. They fuse the flexibility of cryptocurrencies with the reliability of traditional financial systems, creating a seamless avenue for trading, payments, and DeFi integration.

Several reputable sources highlight their design philosophy: they’re purpose-built to offer price stability and trusted usability within the biitland.com ecosystem.

2. Key Features That Elevate Biitland.com Stablecoins

• Asset-Backed Transparency

Each biitland.com stablecoin is fully backed by fiduciary reserves—either fiat currency or commodities—held securely in custodial institutions or decentralized vaults. Periodic audits and proof-of-reserve disclosures provide full transparency to users.

• Multi-Network Interoperability

Designed for seamless compatibility, these stablecoins operate across leading blockchains such as Ethereum, Binance Smart Chain (BSC), Polygon, and Biitland’s native network. This enhances convenience and reduces transaction costs.

• Smart Contract–Driven Governance

Issuance and burning mechanisms are controlled by smart contracts, minimizing human error and manipulation. Coupled with decentralized governance features, this ensures objective and transparent control.

• Easy Fiat Onboarding

Biitland.com integrates fiat on/off ramps directly into its platform, enabling users to convert between fiat and stablecoins effortlessly.

• Regulatory-First Approach

Built with compliance in mind, biitland.com stablecoins adhere to global KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, strengthening trust and credibility.

3. Types of Biitland.com Stablecoins

Biitland.com offers multiple variants tailored to diverse needs:

- BLUSD – pegged 1:1 to the US Dollar for trading, lending, and payments.

- BLEUR – euro-pegged token designed for EU users and cross-border transfers.

- BLGOLD – pegged to one gram of gold; ideal for inflation protection.

- BLDEX – liquidity-stabilizing token for use within Biitland’s decentralized exchange.

4. Advantages of Using Biitland.com Stablecoins

• Enhanced Price Stability

Avoid the shock of crypto volatility and transact confidently with a stable value underpinning your digital assets.

• Low Transaction Costs

Thanks to cross-chain compatibility and Layer 2 support, transactions are fast and inexpensive.

• Passive Income via Staking

Users can stake stablecoins and earn returns—turning idle assets into income-generating capital within Biitland’s DeFi ecosystem.

• Borderless Remittance

Send value internationally without SWIFT fees or delays, making biitland.com stablecoins perfect for freelancers and global businesses.

• DeFi Integration

BLUSD and BLEUR can be added to liquidity pools, yield farming setups, or lending platforms, opening new avenues for growth.

• Strong Backing & Sustainability

Transparent reserve management ensures every stablecoin is verifiably collateralized, building long-term trust.

5. How Do These Stablecoins Stack Up Against Others

| Feature | Biitland.com Stablecoins | Other Stablecoins (e.g., USDT, USDC, DAI) |

| Reserve Transparency | Real-time, audited on-chain | Varies—occasional audits only |

| Collateral Types | Fiat, gold, liquidity | Mostly fiat or crypto-backed |

| Decentralization | Smart contract + DAO governance | Often centralized issuers |

| Fiat On/Off Integration | Native, fully integrated | Often reliant on third-party services |

| Multi-Chain Support | Ethereum, BSC, Polygon, Biitland’s chain | Typically limited to one or two networks |

| Compliance Focus | Built-in KYC/AML protocols | Compliance varies by platform |

| Utility Integration | DeFi, remittance, staking, payments | Generally limited to trading or liquidity |

Biitland.com’s offering particularly shines in regulatory adherence, transparency, and multi-purpose usability.

6. Security and Risk Protections

Biitland.com embeds robust security protocols:

- Quarterly code audits by top-tier cybersecurity firms.

- Bug bounty programs against exploits.

- Insurance reserves to safeguard against de-pegging events.

- Distributed oracle systems to prevent price manipulation.

7. Real-World Applications

• Cross-Border Payments

Eliminate traditional transfer delays and fees—ideal for personal and corporate global transactions.

• Payroll Solutions

Pay freelancers or remote teams in pegged digital assets, securing value across currencies.

• eCommerce Payments

Retailers can accept payments in biitland.com stablecoins without risking exchange-rate loss.

• Humanitarian Aid

NGOs and relief organizations can disburse value quickly to high-inflation areas without arduous banking procedures.

8. Governance and Ecosystem Structure

Governance draws from a balanced council model—incorporating:

- Community delegates elected by token holders.

- Institutional financiers, tech auditors, and legal advisors.

This system ensures collaborative decision-making on collateral updates, issuance changes, and new protocol adaptations.

9. Using Biitland.com Stablecoins

- Visit biitland.com and register an account (KYC required for full access).

- Choose your preferred stablecoin (BLUSD, BLEUR, BLGOLD, BLDEX).

- Use fiat on/off ramps to deposit or withdraw.

- Utilize the coin for purchases, remittances, staking, or trading.

- Stay informed via Biitland’s resources—blog, help center, and educational tools.

10. Challenges & Future Outlook

While promising, biitland.com stablecoins face hurdles:

- Scaling during mass adoption — mitigated through Layer-2 and modular infrastructure.

- Regulatory complexities across jurisdictions — tackled via compliance-first architecture.

- Market education — addressed through user-friendly tutorials and the Biitland Academy.

Roadmap highlights include rolling out educational platforms, enhancing Layer-2 integrations, and strategic expansion into high-inflation regions.

FAQs

Q1. What makes biitland.com stablecoins unique compared to USDT or USDC

Their dynamic reserve model, diversified collateral (fiat, gold, liquidity), full on-chain transparency, integrated compliance, and smart contract governance set them apart

Q2. Are these stablecoins safe for everyday use

Yes—they benefit from routine audits, oracle defenses, insurance reserves, and secure smart contracts.

Q3. Can I convert them back to fiat

Absolutely. Biitland’s integrated fiat on/off ramps enable smooth redemption and withdrawal.

Q4. Who oversees the governance

A multi-stakeholder governance council with representatives from the community, institutions, auditors, and legal experts manages key system updates.

Q5. How do I begin using them

Sign up at biitland.com, complete KYC, select your stablecoin, fund via fiat or crypto, and start using or staking.

Conclusion

Biitland.com stablecoins embody a thoughtful next-generation DeFi solution—melding real-world collateral, blockchain transparency, regulatory compliance, multi-chain utility, and robust governance. Whether you’re seeking stability for daily transactions, remittances, staking, or DeFi engagement, these stablecoins provide an accessible, secure, and promising option for both newcomers and seasoned users