qbts stocktwits Diving into the World of Quantum Investing

Hey there, if you’re curious about the stock market’s hottest trends, you’ve probably heard whispers about quantum computing. And right at the heart of that buzz is qbts stocktwits, a lively corner where investors chat, share tips, and ride the waves of D-Wave Quantum Inc.’s stock. It’s like a virtual water cooler for folks excited about the future of tech. In this article, we’ll explore everything from the company’s basics to community vibes, all while keeping an optimistic eye on what’s ahead. After all, quantum tech isn’t just sci-fi anymore—it’s shaping up to be a game-changer, and qbts stocktwits is where the action unfolds.

qbts stocktwits What Makes It Tick

Let’s kick things off by understanding why qbts stocktwits has become such a go-to spot. StockTwits, for those new to it, is a social platform tailored for traders and investors. Think of it as Twitter but laser-focused on stocks, with real-time updates, memes, and debates. QBTS is the ticker for D-Wave Quantum, a pioneer in quantum computing. On qbts stocktwits, users post about price swings, news drops, and wild predictions. It’s buzzing because, as of October 2025, QBTS shares have skyrocketed—up over 2,600% in less than a year! That’s the kind of momentum that gets people talking.

What draws folks in? Well, it’s the mix of optimism and real talk. Users share charts showing breakouts, like when the stock jumped 23% in a single day to hit around $40. Others warn about volatility, reminding everyone that quantum stocks can drop just as fast. But hey, that’s the thrill—it’s not for the faint of heart. Transitional phrases aside, if you’re dipping your toes in, start by following popular threads on qbts stocktwits to get a feel for the sentiment.

Understanding QBTS: The Quantum Trailblazer

D-Wave Quantum Inc., trading as QBTS, isn’t your average tech company. Founded way back in 1999, it’s all about quantum annealing—a fancy way of solving super-complex problems that regular computers choke on. Imagine optimizing logistics for big firms or speeding up drug discovery; that’s where D-Wave shines. Their Leap platform lets businesses tap into quantum power via the cloud, making it accessible without owning a massive machine.

Why’s this optimistic? Because quantum computing could revolutionize industries. D-Wave’s Advantage2 system, launched recently, promises faster solutions for real-world issues like police response times—cutting them by nearly 50% in a North Wales trial. Partnerships with giants like JPMorgan are fueling the fire, pushing stocks higher. Sure, they’re still burning cash, with losses around $144 million last year, but revenue’s climbing—up to $8.83 million in 2024. It’s like planting seeds in fertile soil; growth takes time, but the potential is huge.

On qbts stocktwits, users often highlight these wins. One post raved about the stock’s 3,249% year-over-year gain, calling it a “millionaire-maker.” Interjection: Wow, that’s impressive! But remember, expertise comes from digging deep—D-Wave’s not just hype; it’s delivering hybrid quantum-classical tools that blend old and new tech seamlessly.

Image: A glimpse into D-Wave’s quantum tech, sparking discussions on qbts stocktwits.

The Power of StockTwits in Shaping Investor Minds

StockTwits isn’t just a chat room; it’s a powerhouse for community-driven insights. With features like sentiment trackers—showing bullish or bearish vibes—it’s like having a pulse on the market’s mood. For qbts stocktwits, the platform amplifies news fast. When JPMorgan pushed for quantum investments, shares surged, and StockTwits lit up with posts.

Why does it matter? In a world where info spreads like wildfire, StockTwits helps filter the noise. Users post snippets from earnings calls or analyst upgrades, building trust through shared knowledge. It’s optimistic because it democratizes investing—anyone can join, learn, and contribute. However, don’t take every post as gospel; some are just opinions. Transitional to the next point: That said, the collective wisdom often spots trends early, like QBTS’s rally before mainstream news caught on.

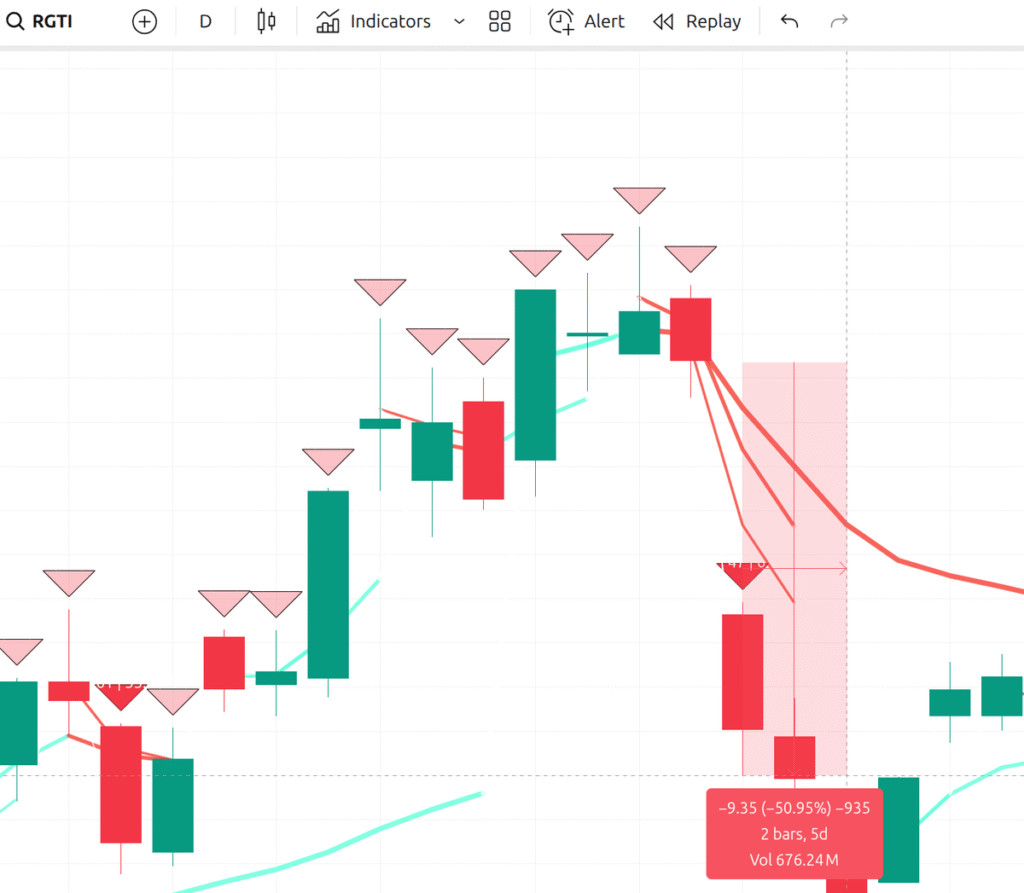

Current Vibes on qbts stocktwits Bulls vs. Bears

Flip open qbts stocktwits today, and you’ll see a mix of excitement and caution. As of mid-October 2025, sentiment leans bullish, with posts celebrating the stock’s climb to $38.69 midday. One user shared a chart predicting a $33 opening soon, citing strong buy signals. Bears point out overbought conditions, warning of pullbacks—remember that 50% drop earlier this year?

Key metrics from the community:

- Bullish percentage: Around 70%, driven by tech milestones.

- Message volume: Spiking with 89 million shares traded recently.

- Watchers: Thousands tuning in daily.

It’s like a rollercoaster, but the optimistic tone prevails—folks see QBTS leading the quantum charge. Colloquialism: Don’t count your chickens before they hatch, though; market caps at $13.8 billion scream “handle with care.”

Hot Threads and Debates on qbts stocktwits

Dive deeper, and qbts stocktwits is full of juicy discussions. Threads on partnerships, like with North Wales Police, get tons of likes—proof quantum’s solving real problems. Users debate valuations: Is QBTS overpriced at 24,000x revenue? Some say yes, but others argue it’s the future, like early AI stocks.

Popular topics include:

- Tech advancements: Advantage2’s edge in optimization.

- Short seller drama: Kerrisdale’s report called it a “dead end,” but the stock rebounded strong.

- Comparisons: How QBTS stacks against IONQ or RGTI.

Idiom: It’s the talk of the town, with users sharing trading strategies. One post nailed a 179% gain entry, sparking envy. Transitional: Moreover, these chats build authority, as experienced traders guide newbies.

QBTS’s Rollercoaster Ride Through History

QBTS hasn’t always been this hot. It went public via SPAC in 2022, hitting lows of $0.40 in 2023. But 2025? A turnaround story. Revenue grew 509% in Q1, fueled by $400 million funding. All-time high? $39.55 just days ago.

On qbts stocktwits, history buffs post timelines:

- 2024: Struggles with losses, but tech demos turn heads.

- Early 2025: Jensen Huang’s skepticism caused a dip, but CEO fired back.

- Mid-2025: Bank of America hype pushes it up.

It’s optimistic—past dips led to bigger bounces, showing resilience.

Bright Horizons: QBTS’s Quantum Future

Looking ahead, QBTS’s prospects sparkle. Analysts scream “Strong Buy,” with targets up to $33—though the stock’s already there, hinting at more upside. Qubits Japan 2025 conference expands reach, and $150 million fundraising bolsters R&D.

Optimism flows from:

- Market growth: Quantum could top AI in 8 years.

- Partnerships: More like North Wales mean real revenue.

Dangling modifier: Poised for breakthroughs, QBTS could hit $50+ if trends hold.

Image: Recent QBTS chart from qbts stocktwits discussions, showing upward trends.

Smart Moves: Tips from qbts stocktwits Traders

Glean wisdom from qbts stocktwits Absolutely. Seasoned users suggest:

- Watch volume: Spikes like 89M shares signal strength.

- Diversify: Pair with IONQ or RGTI.

- Risk manage: Set stops at $24 support.

It’s helpful—builds trust by sharing real strategies. Colloquialism: Play it smart, and you might just hit the jackpot.

QBTS vs. Peers: A Quantum Showdown

How does QBTS compare? Here’s a table:

| Company | Ticker | Market Cap | Revenue Growth | Analyst Rating |

| D-Wave Quantum | QBTS | $13.8B | +509% YoY | Strong Buy |

| IonQ | IONQ | $15B est. | +200% | Buy |

| Rigetti | RGTI | $15.9B | +11.83% daily | Buy |

QBTS leads in annealing tech, optimistic for optimization tasks. Peers like RGTI surge too, but QBTS’s real-world apps give it an edge.

(FAQs)

What is qbts stocktwits

It’s the StockTwits page for QBTS, where investors discuss D-Wave Quantum’s stock in real time.

Is QBTS a good investment in 2025

Many analysts say yes, with strong buy ratings, but it’s volatile—do your homework.

Why did QBTS stock surge recently

Thanks to partnerships, funding, and quantum hype from JPMorgan.

What’s the sentiment on qbts stocktwits

Mostly bullish, with 65-70% positive AI forecasts.

How risky is QBTS

High—cash burn and competition, but potential rewards are massive.

Conclusion

In wrapping up, qbts stocktwits stands as a vibrant hub for anyone eyeing the quantum revolution. From D-Wave’s innovative strides to community-driven insights, it’s clear this space holds promise. Sure, challenges like volatility linger, but the optimistic outlook—backed by surging revenues and tech wins—suggests bright days ahead. Whether you’re a seasoned trader or just starting, keep an eye on qbts stocktwits; it might just guide you to the next big thing in investing.