Jerome Powell Net Worth A Journey from Wall Street to Economic Stewardship

Hey there, folks—imagine steering the world’s biggest economy through storms like pandemics and inflation spikes, all while keeping your cool. That’s Jerome Powell for you, the steady hand at the Federal Reserve’s wheel. As we dive into Jerome Powell net worth, we’ll uncover not just the dollars and cents, but the story of a guy who’s turned smarts and savvy into real impact. It’s inspiring, really, how one person’s path can light the way for us all to build brighter financial futures. Buckle up; this tale’s got twists, triumphs, and a heap of lessons that’ll stick with you.

Early Life and the Spark of Ambition

Jerome Hayden Powell, or “Jay” to those in the know, kicked off his adventure on February 4, 1953, right in the heart of Washington, D.C. Picture this: the fifth of six kids in a bustling family, young Jay growing up amid the hum of politics and power plays. His dad worked in journalism, which probably planted those early seeds of curiosity about how the world ticks—especially the money side of things.

School was no drag for him; oh no, Powell shone bright. He zipped through Georgetown Preparatory School in North Bethesda, Maryland, where he first got hooked on public affairs. That fire led him straight to Princeton University, snagging a bachelor’s in politics back in 1975. His senior thesis? A deep dive into South Africa’s investment scene—talk about forward-thinking! It wasn’t just book smarts; Powell had that practical edge, the kind that says, “Hey, let’s make this real.”

From there, he hustled to Georgetown University Law Center, earning his Juris Doctor in 1979. As editor-in-chief of the Georgetown Law Journal, he was already rubbing shoulders with big ideas and bigger brains. But law school wasn’t the endgame; it was the launchpad. Little did folks know then, this foundation would balloon into the impressive Jerome Powell net worth we admire today. It’s a reminder, isn’t it? That grit in your younger years can pay dividends—literally—down the road.

Stepping into the Legal Arena: Foundations of a Financial Mind

Fresh out of law school, Powell didn’t waste a beat. He clerked for Judge Ellsworth Van Graafeiland on the U.S. Court of Appeals for the Second Circuit—fancy talk for learning the ropes from a top judge in New York City. That gig sharpened his legal chops like a whetstone on a blade.

By 1981, he was knee-deep at Davis Polk & Wardwell, a powerhouse firm where corporate law was the name of the game. Then, a quick hop to Werbel & McMillen from 1983 to 1984, handling more of those intricate deals that make lawyers’ heads spin. But here’s the kicker: Powell wasn’t content just shuffling papers. He had that itch for the high-stakes world where law meets money, and boy, did he scratch it right.

These early legal days weren’t flashy, but they built the bedrock. No overnight riches here, yet every case, every contract honed his eye for detail and risk. It’s like laying bricks for a mansion—you don’t see the grandeur till it’s done. And speaking of done, this phase set the stage for Powell’s pivot to investment banking, where the real wealth-building fireworks began. Optimism alert: if Powell could trade courtrooms for boardrooms and thrive, so can we chase our own bold shifts.

The Wall Street Whirlwind: Banking and Beyond

Ah, Wall Street—the land of brass balls and bigger bets. In 1984, Powell traded his suit for something sharper and landed at Dillon, Read & Co., a top-tier investment bank. For six solid years, he navigated mergers, acquisitions, and all the jazz that keeps the financial engine roaring. It was here he learned to spot opportunities others missed, turning numbers into narratives that won deals.

But Powell’s story doesn’t stop at desks and deals. In 1990, opportunity knocked louder when his old boss, Nicholas Brady, got tapped as Treasury Secretary under Presidents Reagan and Bush. Powell jumped ship to D.C., serving first as Assistant Secretary for Financial Institutions, then as Under Secretary for Domestic Finance. Imagine influencing national policy on banks and bonds—heady stuff! He tackled the savings and loan crisis head-on, helping steady a wobbly economy. That stint? Pure gold for his resume and his growing nest egg.

Fast-forward to 1997: Powell joins The Carlyle Group, that global private equity titan, as a partner. For eight years, he led the Industrial Group for their U.S. Buyout Fund, snapping up stakes in transportation and manufacturing outfits. Carlyle’s a beast—managing over $426 billion in assets by 2024—and Powell’s role there? It supercharged his finances. We’re talking smart plays in assets that appreciated like fine wine. By the time he bowed out in 2005, he’d pocketed gains that form the backbone of Jerome Powell net worth.

Yet, he didn’t rest on laurels. Powell founded Severn Capital Partners, his own private investment firm, zeroing in on industrial finance, litigation funding, and specialty deals. Then, a stint as managing partner at the Global Environment Fund from 2008 onward, blending green investments with sharp returns. It’s this whirlwind—law to banking to policy to equity—that paints Powell as a master juggler. And hey, in a world that feels unpredictable, his steady climb whispers hope: with the right moves, anyone can carve out their slice of prosperity.

Jerome Powell during his investment banking days, capturing the intensity of Wall Street life.

Crafting Private Wealth: Investments That Pay Off

Let’s get down to brass tacks—or rather, brass portfolios. Powell’s not one to flaunt, but his financial disclosures paint a vivid picture. As of 2025, Jerome Powell net worth clocks in between $20 million and $55 million, making him the richest Fed Chair since records began in 1948. That’s no small feat, especially on a public servant’s dime.

Dig deeper, and you’ll find a diversified spread that’s smarter than your average bear. Cash assets? Around $9 million, a comfy cushion for rainy days. Stocks? A whopping $23 million portfolio, heavy on broad-market funds like Vanguard’s Total Stock Market Index—though he did trim some sails in 2020, selling $1-5 million amid market jitters. Bonds, mutual funds, and ETFs round out the mix, with stakes in everything from industrials to treasuries. His real estate game shines too: a cozy home in Chevy Chase Village, Maryland (valued at millions), and a vacation spot in Chester, Vermont, for those well-earned escapes.

Past gigs at Carlyle and Severn? They minted fortunes through equity stakes and carried interest—fancy for profit shares on big wins. Even his Treasury days added pension perks. Sure, critics chirp about conflicts, but Powell’s disclosures are squeaky clean, filed yearly to keep things above board. It’s optimistic fodder: in an era of gig economies and side hustles, Powell shows how patient, informed investing can build lasting wealth without the casino vibe.

To break it down simply, here’s a snapshot of key assets from recent filings:

| Asset Type | Estimated Value Range | Notes |

| Cash & Equivalents | $5M – $9M | Liquid safety net for family needs |

| Stock Portfolio | $20M – $25M | Diversified in index funds and blue-chips |

| Real Estate | $4M – $8M | Primary residence + vacation home |

| Bonds & Funds | $3M – $10M | Low-risk government and corporate |

| Private Equity | $5M – $15M | Carryover from Carlyle/Severn |

This table isn’t just numbers; it’s a roadmap. See? Building Jerome Powell net worth isn’t sorcery—it’s strategy, sprinkled with a dash of daring.

Rising to the Fed’s Helm: A Career Pinnacle

By 2010, Powell was itching for more than private deals. He served as a visiting scholar at the Bipartisan Policy Center, even swaying Congress on the 2011 debt ceiling drama—talk about clutch! That poise caught President Obama’s eye; in 2012, Powell joined the Federal Reserve Board of Governors. For five years, he shaped monetary policy, blending his banker brain with public good.

Then came the big leagues. In 2017, President Trump tapped him as the 16th Fed Chair, swearing him in February 2018. Critics called it a wild card—no Ph.D. in economics, just law and finance savvy. But Powell proved ’em wrong, navigating the 2020 COVID crash with bold moves: slashing rates to zero, pumping trillions in asset buys to keep markets afloat. Inflation roared later, sure, but his pivot to hikes tamed it without tipping into recession. Re-nominated by Biden in 2022, confirmed 80-19, his term runs to 2026—though 2025 whispers of Trump-era tensions add spice.

As Chair, Powell’s not just calling shots; he’s a global anchor. His pressers? Must-watch TV for investors. And through it all, that Jerome Powell net worth holds steady, a testament to pre-Fed hustle. It’s heartening, really—proves expertise trumps pedigree every time.

Steering Through Storms: Key Decisions and Economic Wins

Powell’s Fed reign? A rollercoaster with more ups than downs, if you ask me. Early on, he kept rates low, fueling a roaring recovery post-Great Recession. Then, bam—COVID hits. In March 2020, he unleashed the big guns: unlimited QE (quantitative easing), emergency lending to keep credit flowing. Markets plunged 34% then? They rebounded like a superball, thanks to his steady voice saying, “We’ve got this.”

Inflation? The beast reared in 2021, hitting 9.1% by mid-year. Powell called it “transitory” at first—oops—but by 2022, he flipped the script, hiking rates 11 times to 5.25-5.50%. It worked: CPI cooled to 2.7% by late 2025, jobs stayed strong at 4% unemployment. Critics gripe about asset bubbles from easy money, widening inequality a tad, but hey, no perfect storm. Powell’s framework review in 2020? Genius, emphasizing flexible averages for 2% inflation.

On crypto? Balanced as ever—welcoming innovation but pushing stablecoin regs. His 2025 speeches? Bullish on resilience, warning of moderated growth but eyeing soft landings. Optimism shines: under Powell, the U.S. dodged deeper scars, proving smart policy lifts all boats.

The Man Behind the Mic: Personal Life and Values

Behind the suits and speeches, Powell’s as down-to-earth as they come. Married to Elissa Leonard since 1985, they’ve raised three kids—Susie, Sam, and Lucy—in Chevy Chase Village. Elissa chairs the local board; Powell? He’s on the country club governors. Family first, always—he’s quipped about selling assets for college tuitions if needed.

Hobbies? A die-hard Grateful Dead fan, Powell’s caught more shows than most. He bikes to work those six miles from home, dodging D.C. traffic like a pro. Philanthropy pulls at his heartstrings: boards for DC Prep charter schools, Princeton’s Bendheim Center, The Nature Conservancy. He co-founded the Center City Consortium for D.C.’s underprivileged kids—giving back, big time.

Registered Republican, yet bipartisan in action, Powell’s life screams balance. In interviews, he’s folksy: “We’re all in this together.” That warmth? It humanizes the Fed, making Jerome Powell net worth feel less like a score and more like earned wisdom.

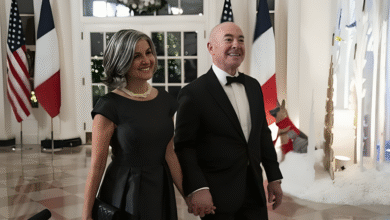

Jerome Powell with family, embodying the grounded side of a high-flying career.

Jerome Powell Net Worth in the Spotlight: Controversies and Scrutiny

No rose without thorns, right? Powell’s wealth draws eyes—$20-55 million? That’s Fed Chair catnip for critics. Elizabeth Warren dubbed him a “dangerous man” in 2018, citing Carlyle ties to lax bank regs. Fair point, but disclosures show no funny business; he divested conflicting assets upon joining.

2020 trading flap? Powell sold $1-5 million in stocks as markets tanked—legal, but optics? Icky. It sparked IG probes, ethics tweaks, and early retirements for other Fed folks. Yet, Powell emerged cleaner, pushing stricter trading rules by 2024. Political heat? Trump’s 2018 tweets called him “crazy,” and 2025 rumors swirl of dismissal letters (denied, phew). Powell’s retort? “I’m independent as the day is long.”

These dust-ups? They test, but don’t topple. Instead, they spotlight transparency’s power. For us mere mortals, it’s a nudge: wealth invites watchdogs, so play straight. Powell’s bounced back, his net worth a shield of legitimacy.

Peers and Predecessors: How Powell Stacks Up

Powell’s not flying solo in the Fed hall of fame. Compare Jerome Powell net worth to Janet Yellen’s $5-13 million—hers from academia, his from equity hustles. Ben Bernanke? Around $3-10 million, crisis-crafter extraordinaire. Alan Greenspan? Whispered $20-40 million from consulting post-Fed.

But Powell tops ’em in raw bucks, thanks to Carlyle windfalls. Table time for a quick glance:

| Fed Chair | Est. Net Worth (2025) | Key Wealth Source |

| Jerome Powell | $20M – $55M | Private equity, investments |

| Janet Yellen | $5M – $13M | Books, speeches |

| Ben Bernanke | $3M – $10M | Consulting |

| Alan Greenspan | $20M – $40M | Post-Fed advisory |

See the pattern? Wall Street breeds wealth; policy polishes it. Powell’s edge? Diversification. It’s uplifting—shows varied paths to financial fitness, no one-size-fits-all.

Legacy in the Making: Powell’s Enduring Mark

As 2025 unfolds, Powell’s chapter isn’t closed—term ends 2026, but his imprint? Etched deep. He’s modernized the Fed: diverse hires, public “Fed Listens” forums, climate risk focus. Economy-wise? From pandemic peril to inflation whip, he’s delivered growth without the gloom.

Critics say asset pumps favored the rich—true-ish, bubbles loomed—but Powell’s data-driven tweaks averted worse. His calm? Priceless in chaos. Looking ahead, with AI booms and green shifts, Powell’s blueprint promises stability. Jerome Powell net worth Just icing; his real riches are in resilient systems that benefit us all. What a ride—proves one voice can harmonize a nation’s fortunes.

FAQs

What’s the main source of Jerome Powell’s wealth

Most of Jerome Powell net worth stems from his private equity days at The Carlyle Group and Severn Capital Partners, plus savvy stock and real estate holdings—not his Fed salary.

How much does Jerome Powell earn as Fed Chair

In 2025, it’s $250,600 annually—modest for the role’s clout, but hey, it covers the basics while his investments do the heavy lifting.

Has Jerome Powell’s net worth changed much since becoming Fed Chair

Not drastically; disclosures show steady $20-55 million range. Public service curbs big swings, but pre-Fed assets keep it robust.

Does Powell invest in cryptocurrencies

He’s hands-off personally—disclosures show no crypto stakes. As Chair, he backs regulation for stability, not speculation.

What’s next for Powell after his Fed term

Rumors swirl of advisory gigs or philanthropy dives, but with his track record, expect more economic wisdom-sharing. Fingers crossed for that soft landing!

Conclusion

Wrapping this up, Jerome Powell net worth isn’t just a number—it’s a beacon of balanced ambition, from D.C. kid to economic oracle. Through legal battles, Wall Street wins, and Fed fires, Powell’s shown us that wealth weaves with wisdom. Sure, storms hit—politics, probes—but optimism wins out. As we face our own financial forks, take a page: diversify, stay ethical, give back. Powell’s story? Proof positive that with heart and hustle, brighter tomorrows aren’t just possible—they’re probable. Here’s to your journey; may it rival Jay’s in every golden way.